The Morning Star Candlestick Pattern: A Comprehensive Guide

The Morning Star candlestick pattern is one of the most powerful and widely recognized reversal patterns in technical analysis. Known for its ability to signal the end of a downtrend and the potential beginning of an uptrend, the Morning Star provides traders with valuable insight into market psychology. This article delves deeply into the Morning Star pattern, examining its formation, interpretation, significance, and how to effectively trade it.

1. What is the Morning Star Candlestick Pattern?

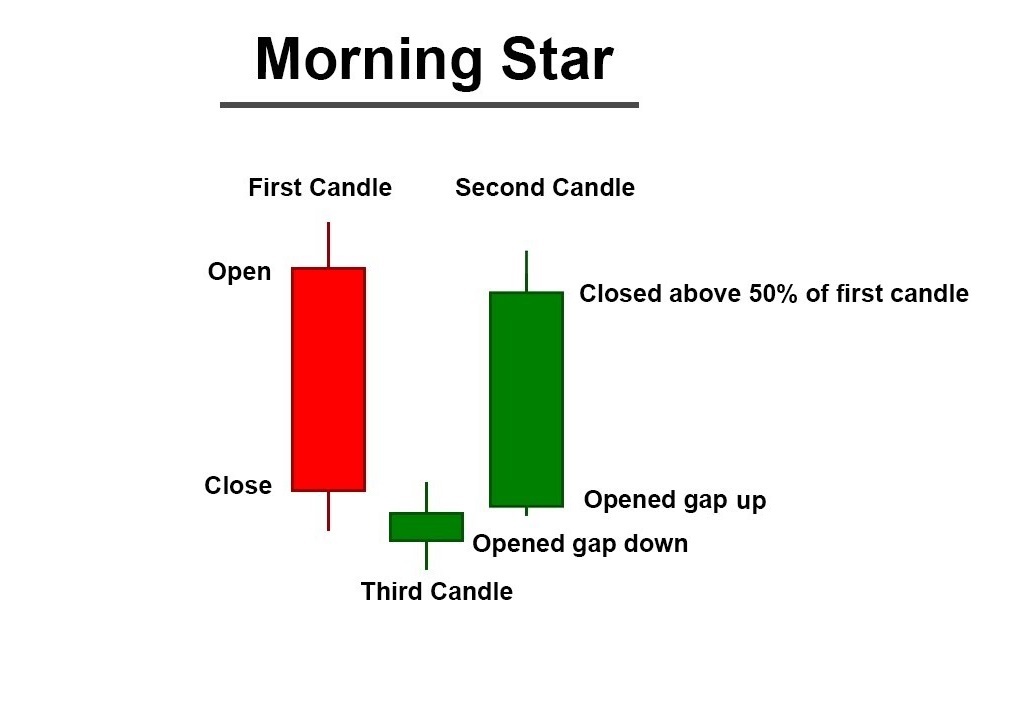

The Morning Star is a three-candlestick pattern that forms at the bottom of a downtrend, signaling a potential bullish reversal. It is characterized by three distinct candlesticks:

- The first candle: A large red (bearish) candlestick, indicating that the market is in a strong downtrend.

- The second candle: A small-bodied candle, which can be either bullish or bearish. This candle represents indecision and shows that the selling pressure from the first candle is waning.

- The third candle: A large green (bullish) candlestick, confirming the reversal and signaling the start of a potential uptrend.

When these three candles appear in sequence, it suggests that the bears have lost control, and the bulls may be taking over the market, making it an essential pattern for traders looking to capitalize on trend reversals.

2. Key Characteristics of the Morning Star Pattern

To accurately identify the Morning Star pattern, there are certain characteristics that traders must look for:

a. Downtrend Preceding the Pattern

The pattern must appear after a significant downtrend to be valid. A steady decline in price signals the strength of the bearish market, and the Morning Star marks the point at which the downtrend may be coming to an end.

b. First Candlestick – Strong Bearish Candle

The first candlestick in the pattern is a long bearish candle. This candle should have a solid body and be significantly longer than the other candles, indicating strong downward momentum and the dominance of sellers in the market.

c. Second Candlestick – Doji or Small Body

The second candle is a small-bodied candle, which could be a Doji, a spinning top, or any small candle. This candle represents indecision in the market. The price action within this candle shows that the sellers are losing their grip, and the market is at a crossroads.

d. Third Candlestick – Strong Bullish Candle

The third candle is a long bullish candle. This candle confirms the reversal, as the bulls step in and push the price upward, completely or partially recovering the losses of the first candle. A large green candle suggests that buyers have taken control and that the trend is likely shifting.

e. Closing Above the Middle of the First Candle

For the Morning Star to be truly valid, the third candle should close above the midpoint of the first candle. This is important because it shows that the buyers have gained enough strength to push the price significantly higher than the lowest point of the downtrend.

3. Psychology Behind the Morning Star Pattern

The psychology behind the Morning Star pattern is crucial in understanding why this pattern can be a reliable reversal signal. Here’s how the pattern unfolds:

- First Candle – Seller Dominance: The first bearish candle shows strong selling pressure. It indicates that the market has been in a downtrend, and the sellers are fully in control.

- Second Candle – Indecision: The small-bodied second candle suggests indecision. This is a transitional period where the momentum from the downtrend starts to fade, but no clear direction has been established yet. The market is essentially “taking a pause.”

- Third Candle – Buyer Control: The final bullish candle indicates a shift in momentum. Buyers have taken control, and the market begins to move higher, potentially reversing the trend. This suggests a shift from bearish to bullish sentiment.

The Morning Star pattern essentially represents a battle between the bears and the bulls, with the bulls winning in the end. It signifies the moment when the downtrend loses steam, and a new uptrend may be about to begin.

4. How to Trade the Morning Star Pattern

The Morning Star candlestick pattern is a powerful tool for traders, but it’s essential to wait for confirmation before acting on it. Here’s how to trade the Morning Star effectively:

a. Wait for Confirmation

The Morning Star pattern should not be acted upon immediately after it forms. The third candlestick, a bullish candle, should confirm the reversal. Traders often look for confirmation by waiting for the next few candlesticks to follow the Morning Star, ensuring that the reversal is genuine and not a false signal.

b. Entry Point

Once the pattern is confirmed, traders typically enter a long (buy) position at the close of the third candlestick, as this is when the market shows strong bullish momentum. In some cases, traders may wait for a break above the high of the third candle for extra confirmation.

c. Stop-Loss Placement

A stop-loss order is crucial to manage risk. A good place for a stop-loss order is just below the low of the second candle, or the low of the first candle, depending on the trader’s risk tolerance. This ensures that if the market reverses and the trade goes against the trader, the loss is limited.

d. Target Price

To determine a target price, traders can look for significant resistance levels or previous highs. The Morning Star pattern often marks the beginning of an uptrend, and traders can use technical tools like Fibonacci retracements, trendlines, or moving averages to identify areas where the price could face resistance.

e. Risk Management

As with any trading strategy, effective risk management is essential. Traders should calculate their risk-to-reward ratio and ensure it is favorable before entering the trade. A typical risk-to-reward ratio for the Morning Star pattern might be 1:2 or higher, meaning the potential reward should be at least twice the potential risk.

5. Best Indicators to Confirm the Morning Star Pattern

While the Morning Star pattern is effective on its own, using additional indicators can provide confirmation and improve the reliability of the signal. Here are some of the best indicators to use alongside the Morning Star pattern:

a. Volume

Volume is an essential indicator to confirm the Morning Star pattern. When the third candle is accompanied by higher-than-average volume, it confirms that the buyers are truly in control, as strong volume indicates that many market participants are participating in the move.

b. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures overbought or oversold conditions. If the RSI is near the oversold level (below 30) during the formation of the Morning Star, it adds further confirmation to the reversal signal. As the Morning Star appears, the RSI should start moving back toward the neutral zone, indicating that the downtrend may be over.

c. Moving Averages

Moving averages can be used to identify the overall trend and to confirm the reversal. If the price crosses above a key moving average (such as the 50-period or 200-period moving average) after the Morning Star pattern, it suggests that the trend may have shifted from bearish to bullish.

d. MACD (Moving Average Convergence Divergence)

The MACD indicator is another useful tool for confirming trend reversals. When the MACD line crosses above the signal line, it signals a bullish momentum shift, which can confirm the Morning Star pattern.

e. Support and Resistance Levels

Support and resistance levels are key areas where price may reverse. If the Morning Star pattern forms near a significant support level, it strengthens the pattern’s reliability. Similarly, if the price starts moving up after the Morning Star, traders should look for the next resistance level as a potential target for profit-taking.

6. Common Mistakes to Avoid When Trading the Morning Star

While the Morning Star pattern is a powerful tool, traders often make several mistakes when using it. Here are some common mistakes to avoid:

a. Ignoring Confirmation

One of the biggest mistakes is entering a trade too early without waiting for confirmation. A single candlestick pattern is not enough to predict a reversal with certainty, so waiting for additional confirmation, such as a strong bullish follow-up candle, is crucial.

b. Misinterpreting the Pattern

Not all three-candle patterns are Morning Stars. Traders should be careful not to mistake a pattern with a small body for a Morning Star when it doesn’t have the required characteristics, such as the strong bearish first candle and the bullish third candle.

c. Overtrading

Some traders may become overzealous when they see a Morning Star pattern, entering trades too frequently or with large positions. Proper risk management and patience are key to successful trading.

d. Failure to Manage Risk

Traders should always use stop-loss orders to limit their risk. Failing to set appropriate stop-loss levels or trading without a clear exit strategy can lead to significant losses if the market does not reverse as expected.

7. Conclusion

The Morning Star candlestick pattern is a powerful and reliable tool for identifying potential bullish reversals in the market. When properly interpreted and used with confirmation, the Morning Star can provide traders with lucrative opportunities to enter new trends. However, like all trading strategies, it requires patience, discipline, and sound risk management to be successful.

By understanding the Morning Star’s formation, psychology, and trading strategies, traders can enhance their ability to predict market movements and make more informed trading decisions. Incorporating the Morning Star with other technical indicators and confirming signals can further increase its effectiveness and improve the overall success rate of trades.