The Piercing Line Candlestick Pattern: A Comprehensive Guide

The Piercing Line is a significant candlestick pattern in technical analysis, often considered a bullish reversal pattern. It is formed by two candles: a long bearish (red) candlestick followed by a long bullish (green) candlestick. This pattern appears after a downtrend and is used by traders to identify potential buying opportunities, suggesting that the market may be transitioning from bearish to bullish. In this detailed article, we will explore the Piercing Line pattern’s structure, psychology, interpretation, and trading strategies.

1. What is the Piercing Line Candlestick Pattern?

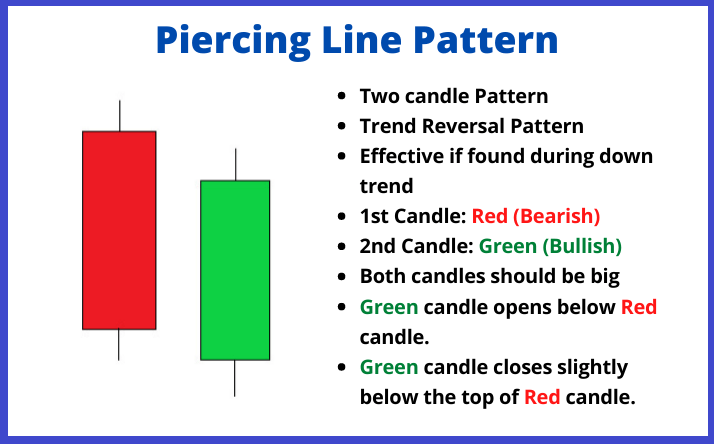

The Piercing Line is a two-candlestick pattern that typically occurs at the bottom of a downtrend. It indicates a potential bullish reversal, signaling that the bears may have exhausted their strength and the bulls are taking control. The pattern consists of the following two candlesticks:

- First Candle – Bearish Candle: The first candle in the Piercing Line pattern is a long bearish candlestick, indicating a continuation of the downtrend. The long red candle shows that the bears are in control, and the market is moving lower.

- Second Candle – Bullish Candle: The second candle is a long bullish candlestick that opens below the low of the first candlestick but closes above the midpoint of the first candlestick. The bullish candle indicates that the buying pressure is gaining momentum, signaling a potential reversal of the previous downtrend.

When this pattern forms, it suggests that the market may be shifting from a period of bearish sentiment to a period of bullish sentiment, making it an important pattern for traders to watch for when they are looking for potential buying opportunities.

2. Key Characteristics of the Piercing Line Pattern

To effectively identify and trade the Piercing Line pattern, traders should look for certain characteristics that define the pattern. These characteristics include:

a. Downtrend Preceding the Pattern

The Piercing Line pattern should only form after a significant downtrend. This is essential for the pattern to have its full effect as a reversal signal. The downtrend establishes that the market is in a bearish phase, and the Piercing Line pattern signals that the trend may be coming to an end.

b. First Candle – Long Bearish Candle

The first candlestick in the Piercing Line pattern is a long bearish candle. This candle suggests that the bears have been in control of the market and that prices have been falling steadily. The longer the bearish candlestick, the more significant the downtrend has been, and the more potent the potential reversal may be.

c. Second Candle – Long Bullish Candle

The second candlestick is a long bullish candle that opens lower than the first candlestick’s low but closes at least halfway up the body of the first candlestick. The fact that the second candle closes above the midpoint of the first candle is what distinguishes the Piercing Line pattern from other candlestick patterns. This shows that the bulls are gaining strength and may soon take over the market.

d. Confirmation of the Reversal

For the Piercing Line pattern to be confirmed, the second candle must close above the midpoint of the first candle. This closing above the midpoint is crucial, as it indicates that the bulls are asserting their dominance and that the bearish momentum may be waning.

e. Volume Consideration

Volume is an essential factor to consider when interpreting the Piercing Line pattern. A higher volume on the second candlestick is often seen as a confirmation of the reversal. Increased volume during the formation of the second candlestick indicates that more traders are entering the market, and the buying pressure is strong.

3. The Psychology Behind the Piercing Line Pattern

To better understand the significance of the Piercing Line pattern, it’s helpful to analyze the psychology behind the formation of these candlesticks:

- First Candle – Bearish Sentiment: The first candlestick represents the bears in control of the market. The long bearish candle shows that the market is continuing in its downtrend and that selling pressure is strong. During this phase, traders are pessimistic about the market’s future, leading to a sustained period of falling prices.

- Second Candle – Reversal of Sentiment: The second candlestick signals a shift in market sentiment. As the price opens lower (below the first candlestick’s low) and then rallies back above the midpoint of the first candlestick, it shows that the bears may be losing control, and buyers are stepping in. This shift in sentiment suggests that the market may soon reverse, as the bulls are beginning to dominate.

- Market Transition: The Piercing Line pattern is a clear signal of the market’s transition from bearish to bullish sentiment. The shift from a long bearish candle to a strong bullish candle marks a change in psychology and indicates that buyers are starting to take charge, which could lead to a reversal of the previous downtrend.

4. How to Trade the Piercing Line Pattern

The Piercing Line pattern is a valuable tool for identifying potential bullish reversals, but like any candlestick pattern, it requires careful interpretation and confirmation. Below are the steps to trade the Piercing Line pattern effectively:

a. Wait for Confirmation

The first and most important rule when trading the Piercing Line pattern is to wait for confirmation. The second candlestick should close above the midpoint of the first candlestick. This confirms that the buyers have gained control and the market may be reversing to the upside.

b. Entry Point

The ideal entry point for a long position is when the price breaks above the high of the second candlestick. This indicates that the bullish momentum is continuing and that the reversal is likely to be sustained. Traders may also enter the trade at the close of the second candlestick, though waiting for further confirmation can provide additional security.

c. Stop-Loss Placement

Stop-loss placement is critical for managing risk in any trade. A good stop-loss level for the Piercing Line pattern is just below the low of the first candlestick or the low of the second candlestick. This ensures that if the pattern fails and the market continues to decline, your losses are limited.

d. Target Price

The target price for a trade based on the Piercing Line pattern can be determined by looking at nearby resistance levels or using other technical analysis tools like Fibonacci retracements, moving averages, or previous highs. A common approach is to aim for a risk-to-reward ratio of at least 2:1, meaning the potential reward should be at least twice the risk.

e. Volume Confirmation

It is essential to monitor the volume during the formation of the pattern. A strong Piercing Line pattern is usually accompanied by higher volume on the second candlestick, indicating that there is substantial interest from buyers. Higher volume helps confirm the strength of the reversal and the likelihood that the trend will continue in the direction of the bulls.

5. Best Indicators to Confirm the Piercing Line Pattern

While the Piercing Line is a powerful candlestick pattern on its own, using additional technical indicators can help confirm the pattern’s reliability and increase the chances of a successful trade. Below are some of the best indicators to use alongside the Piercing Line pattern:

a. Volume

Volume plays a crucial role in confirming the strength of the Piercing Line pattern. Increased volume during the formation of the second candle is a strong signal that the reversal is likely to occur. Low volume can weaken the reliability of the pattern, as it suggests that the reversal may not have enough momentum to sustain itself.

b. Relative Strength Index (RSI)

The RSI is a momentum oscillator that helps identify overbought and oversold conditions. If the RSI is in the oversold region (below 30) when the Piercing Line pattern forms, it adds extra confirmation that the trend could reverse. A rise in the RSI after the formation of the pattern suggests that bullish momentum is building.

c. Moving Averages

Moving averages, such as the 50-period or 200-period moving average, can be used to determine the overall trend. If the price breaks above a key moving average after the Piercing Line pattern forms, it suggests that the bullish trend is gaining strength and that the reversal is likely to continue.

d. MACD (Moving Average Convergence Divergence)

The MACD is another useful tool to confirm the Piercing Line pattern. A bullish crossover of the MACD line (when it crosses above the signal line) after the pattern forms can help confirm the upward momentum and increase the likelihood of a successful trade.

e. Support and Resistance Levels

Support and resistance levels are critical for determining potential entry and exit points. If the Piercing Line pattern forms near a strong support level and the price breaks above resistance levels after the pattern completes, it provides additional confirmation of the reversal.

6. Common Mistakes to Avoid When Trading the Piercing Line

While the Piercing Line pattern is a reliable reversal signal, traders often make several mistakes that can lead to poor trade outcomes. Below are some common mistakes to avoid:

a. Entering Too Early

Traders should avoid entering a trade based on the appearance of the pattern alone. The second candlestick must close above the midpoint of the first candle for confirmation. Entering too early without waiting for confirmation increases the risk of false signals and losses.

b. Ignoring Volume

Volume is an important factor for confirming the strength of the Piercing Line pattern. Ignoring volume or trading the pattern in low-volume environments can result in weaker reversals, as there may not be enough interest from buyers to sustain the upward move.

c. Failure to Use Stop-Loss

Proper stop-loss placement is essential to manage risk. Traders who fail to set stop-loss orders or place them too far away from the entry point may face significant losses if the pattern does not play out as expected.

d. Overlooking Other Indicators

The Piercing Line pattern should not be traded in isolation. Traders should always use other technical indicators, such as RSI, MACD, or moving averages, to confirm the pattern and improve their chances of success.

7. Conclusion

The Piercing Line candlestick pattern is a powerful bullish reversal signal that occurs after a downtrend, indicating that the market may be transitioning from bearish to bullish sentiment. By understanding the structure and psychology behind the pattern, traders can identify potential buying opportunities and improve their chances of success in the markets. However, it is essential to wait for confirmation, use volume analysis, and combine the pattern with other technical indicators to maximize the effectiveness of the strategy. By following proper risk management practices and avoiding common mistakes, traders can leverage the Piercing Line pattern to enhance their trading strategies.