Understanding the Head and Shoulders Pattern in Stock Market Trading

The Head and Shoulders pattern is one of the most reliable and widely recognized chart patterns in technical analysis. It signals a potential reversal in a trend and is used by traders to predict price movements in the stock market. This comprehensive guide explores the structure, variations, significance, and strategies for trading with the Head and Shoulders pattern.

What is the Head and Shoulders Pattern?

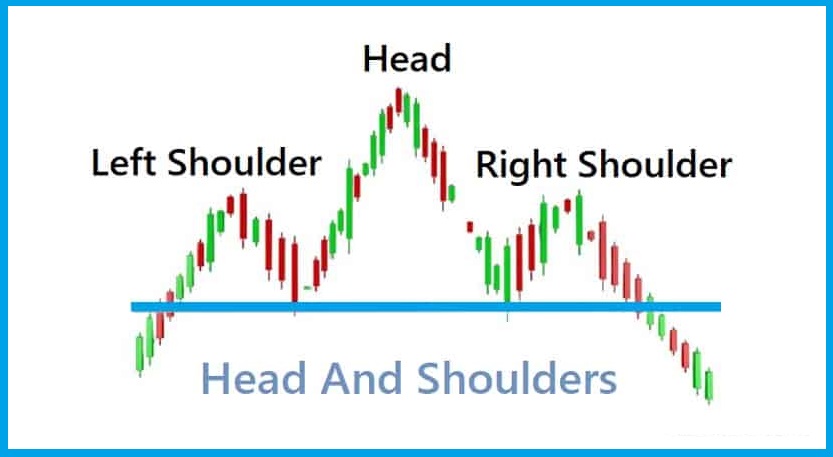

The Head and Shoulders pattern is a formation on a price chart that indicates a reversal from a bullish trend to a bearish trend or vice versa. It consists of three peaks:

- Left Shoulder: A peak followed by a temporary decline.

- Head: A higher peak followed by another decline.

- Right Shoulder: A peak similar in height to the left shoulder, followed by a decline.

The line connecting the lows of the two declines forms the neckline, which is a crucial level for confirming the pattern.

Types of Head and Shoulders Patterns

There are two main types of Head and Shoulders patterns:

- Standard (Bearish Reversal):

- Indicates a reversal from an uptrend to a downtrend.

- Breaks below the neckline signal the start of a bearish move.

- Inverse (Bullish Reversal):

- Indicates a reversal from a downtrend to an uptrend.

- Breaks above the neckline suggest the start of a bullish move.

How to Identify the Pattern

To identify the Head and Shoulders pattern accurately, traders look for the following characteristics:

- Clear Trend:

- A preceding trend (bullish for a standard pattern, bearish for an inverse pattern).

- Symmetry:

- The shoulders should ideally be similar in height and duration.

- Neckline:

- The neckline can be horizontal or sloped, acting as a key support or resistance level.

- Volume:

- Volume typically decreases during the formation of the pattern and increases during the breakout.

Trading the Head and Shoulders Pattern

Trading with the Head and Shoulders pattern involves a systematic approach:

- Confirmation:

- Wait for a clear breakout of the neckline with significant volume.

- Entry Points:

- Enter a trade after the price breaks the neckline. For conservative traders, a retest of the neckline offers an additional confirmation.

- Stop-Loss Placement:

- Place a stop-loss above the right shoulder for bearish patterns and below the right shoulder for bullish patterns.

- Target Price:

- The target is calculated by measuring the distance between the head and the neckline and projecting it in the breakout direction.

Advantages of the Head and Shoulders Pattern

- Reliability:

- Offers high accuracy when correctly identified.

- Ease of Recognition:

- The pattern is visually distinctive and relatively simple to spot.

- Predictive Power:

- Provides clear entry, stop-loss, and target levels.

Limitations and Risks

- False Breakouts:

- Not all breakouts lead to sustained moves; false signals are possible.

- Subjectivity:

- Identifying the pattern can be subjective, especially in volatile markets.

- Market Conditions:

- Works best in trending markets; less effective during sideways or choppy price action.

Practical Examples

- Bearish Head and Shoulders:

- A stock rises from $50 to $70 (left shoulder), then to $90 (head), and falls back to $70, forming a neckline. It rises again to $80 (right shoulder) and breaks below $70, triggering a bearish signal.

- Bullish Inverse Head and Shoulders:

- A stock falls from $100 to $80 (left shoulder), drops to $60 (head), and rises back to $80, forming a neckline. It drops to $70 (right shoulder) and breaks above $80, indicating a bullish reversal.

Tips for Successful Trading

- Combine with Indicators:

- Use tools like RSI, MACD, or moving averages to confirm signals.

- Practice Patience:

- Wait for a clear breakout and avoid jumping in prematurely.

- Risk Management:

- Use appropriate position sizing and set stop-loss orders to manage potential losses.

Conclusion

The Head and Shoulders pattern is a powerful tool in a trader’s arsenal, offering reliable signals for trend reversals. By understanding its structure, recognizing variations, and following disciplined trading strategies, traders can effectively incorporate this pattern into their decision-making process. However, like all technical tools, it should be used in conjunction with other analysis methods and proper risk management practices to maximize success in the stock market.